How big is the American debt?

Current Event Friday

You will find more infographics at Statista

You will find more infographics at Statista

Data Scavenger Hunt

Find answers to the following questions using the visual above:

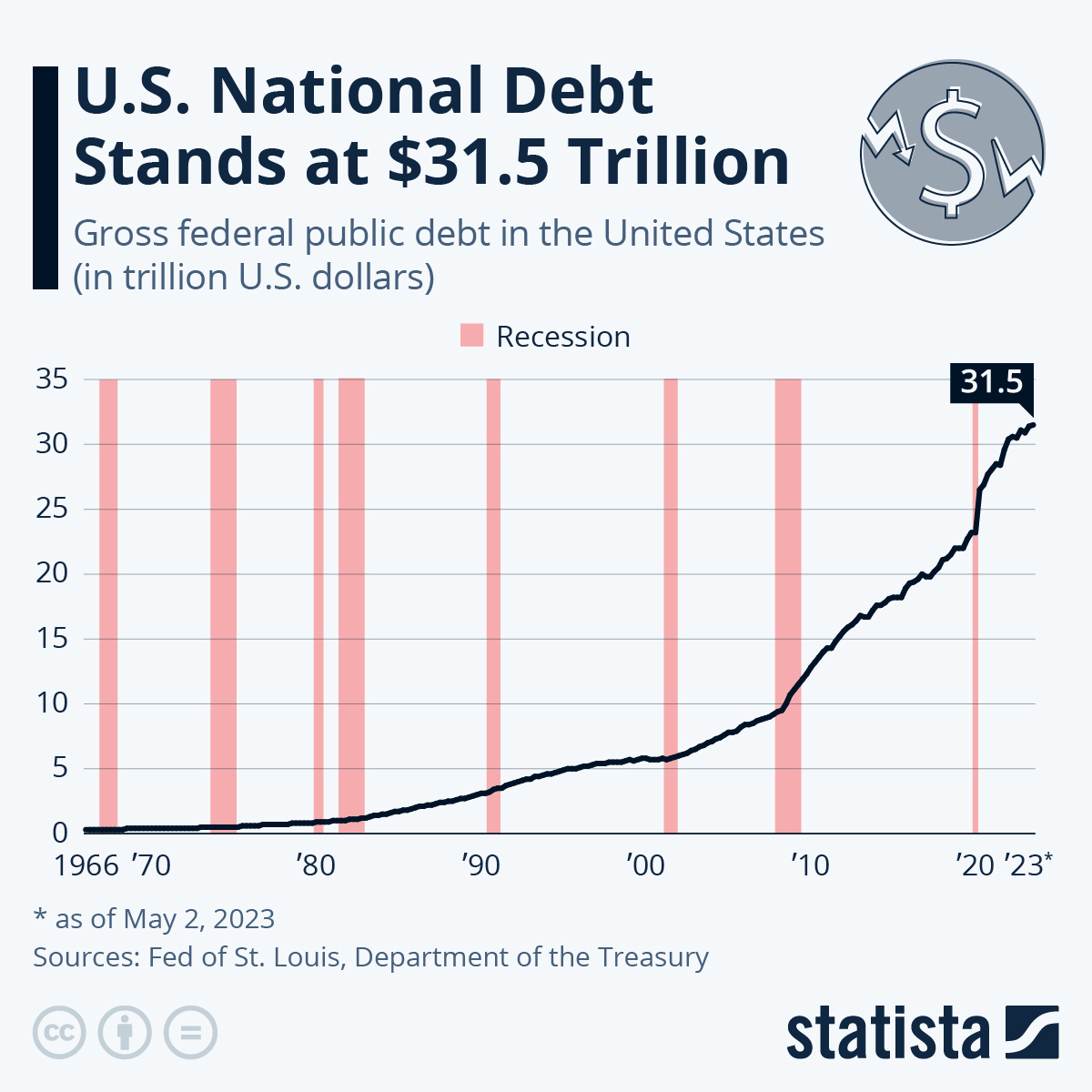

What is the current U.S. federal government (gross federal public) debt?

In 1984 (the year of Stranger Things), what was the approximate U.S. federal government (gross federal public) debt?

How many recessions (economic downturns) has the U.S. had since 1966?

Approximately how much has the U.S. federal government (gross federal public) debt increased since you were born?

What is the big story the visual tells about the rise of federal government debt?

Big Brain Questions

Answer these questions by yourself using your brain and the links below:

List one thing the chart makes you wonder:

Based on the trend in the growth of the debt over the last 20 years, what do you predict the national debt will be in 20 years.

Debt is important, but it’s importance is measured not so much as its total amount but by whether the entity that is in debt (the U.S. government, in this case) has enough money to pay it back. For instance, when most people buy a house they don’t usually have enough cash to buy it. So they borrow the money (take on debt) and then pay it back eventually, with interest. Banks lend home buyers money if they think the home-buyer will likely pay the money (plus interest!) back. If they don’t pay it back, the bank gets to take the house (or whatever the person borrowed money for) back. The U.S. is able to borrow money (at this point, $31.5 trillion!) because the lenders (banks, other countries, individuals, investors) know that since America always pays back it’s bills, American borrowing is the safest investment in the world. Why are investors willing to lend the American government so much money?

One way to measure the ability of a country to pay back its debt is through the debt (how much we owe) to GDP (basically how much a country makes every year) ratio. The current debt to GDP ration in the US. is 122.23. In other words, our debt is bigger than our GDP. A car buyer who defaults usually loses their car. What would happen if the U.S. failed to pay back what it owes?

The bigger the debt the more the government pays in interest and the less it has to spend on other things like roads, defense, hospitals, NASA, etc. How do you think the national debt will impact the world you live in?

Write and Discuss

Take ten minutes to write about the question at the top of the page and then discuss with your classmates.

Act on your Learning

Contact the White House online or by phone - Comments: 202-456-1111 and let them know what you think about the national debt.

Get Creative

Breaking news: 2030 - The national debt is at an all-time high. The government no longer does anything but taxes you and pays interest on the debt. Otherwise, it is bankrupt an has no money to spend. Make a creative response to life in 2030 America.

Learn More

Learn more about the national debt.

After today this lesson will move to our archives. Subscribe for access to the entire Social Studies Lesson Archive!

Access to all our history lessons and labs.