What percent of American wealth is owned by the top one percent richest Americans?

Data Scavenger Hunt

Find answers to the following questions using the visual above:

Identify the share of the national income (all the money made that year in the United States) that corresponds to the blue line?

In 1820, the first year shown in the visual, what percent of the national income was owned by the richest one percent of Americans?

In 1820, what percent of the national income was owned by the bottom fifty percent (poorest half) of Americans as shown with the red line?

In the most recent year shown in the visual, what portion of the national income was owned by the richest one percent?

Describe the changes in the portion of the national income owned by the top one percent wealthiest Americans over time.

Big Brain Questions

Answer these questions by yourself using your brain and the links below:

List one thing the chart makes you wonder:

As the blue line grows American inequality increases; as the red line grows, American inequality decreases. Explain whether, when the red and blue lines cross, America is economically equal.

The word Democracy comes from Greek for “rule by the people,” which means that ultimate political power belongs to the people. In an ideal democracy, political power is roughly equal. When there is a great amount of economic equality, political equality increases. Explain how economic inequality impacts political equality?

Elon Musk’s Net Worth as of July 2023 was $239.2 Billion or $239,200,000,000 whereas, at the same time, the median American wealth was $121,760. Explain whether you and Elon Musk have political equality.

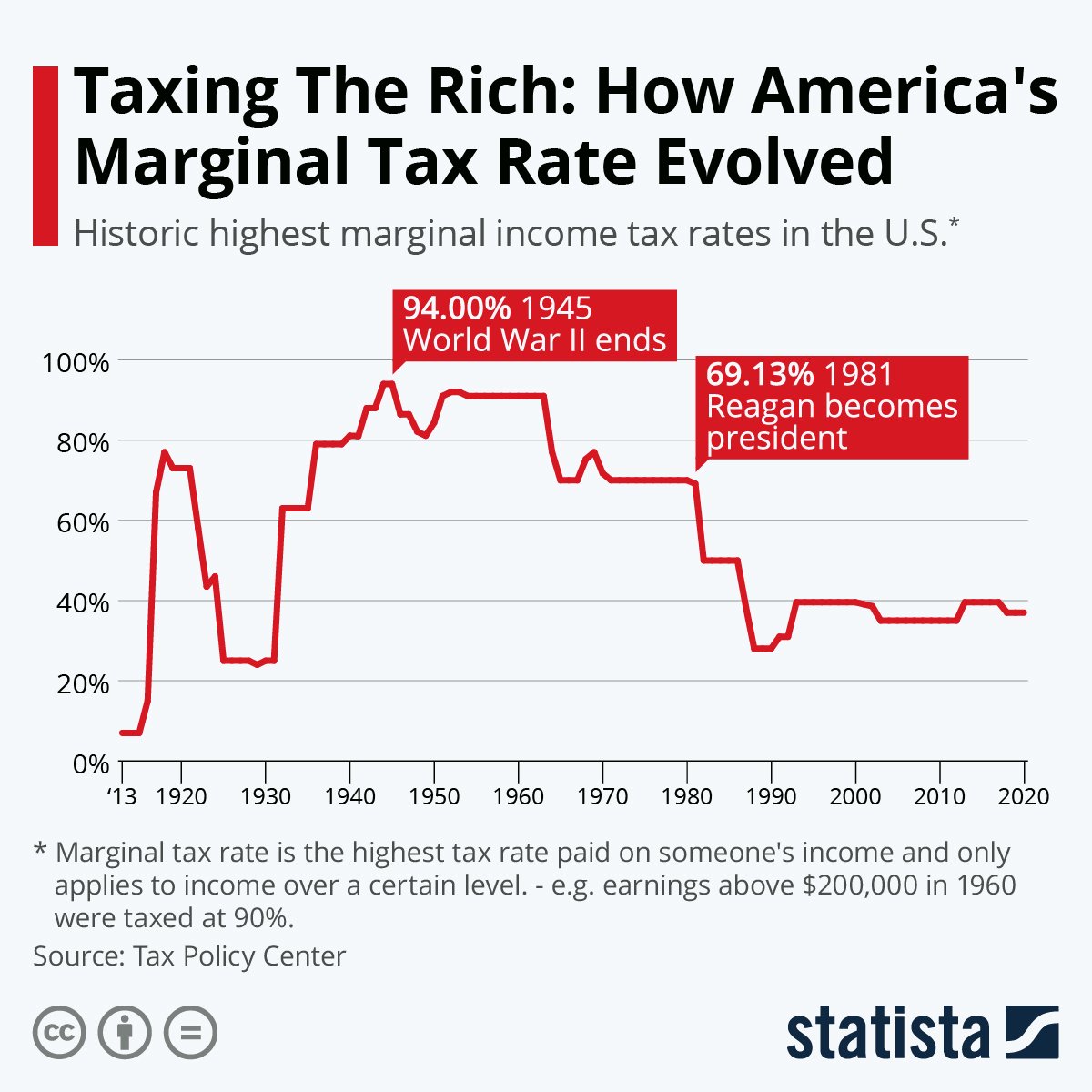

In 1945, the highest tax rate in the United States was 94%; by 1990 it had fallen to 33%. Explain how much power the government has to increase American economic equality.

Write and Discuss

Take ten minutes to write about the question at the top of the page and then discuss with your classmates.

Act on your Learning

The Fair Tax Act of 2023 (H.R. 25) was introduced to the US House of Representatives in January 2023. If passed, the Fair Tax Act would radically restructure the nation’s tax system, replacing individual and corporate income taxes, the estate tax, and the payroll taxes dedicated to Social Security and Medicare with a national sales tax which would allow the nation’s wealthiest families to accumulate even greater intergenerational wealth, thereby widening the nation’s already sizable wealth gap. Contact your House member and let them know what you think about The Fair Tax Act of 2023 . Contact your U.S. Representative to let them know what you think of the Fair Tax Act of 2023.

Get Creative

Breaking news: 2025 - Congress passes the Fair Tax Act and President Trump in his second term signs it into law. How will this impact the country?

Learn More

This lesson is here today but it will be gone tomorrow…unless you subscribe to our Social Studies Archive.

Access to all our history lessons and labs.