How do Americans feel about tariffs?

Critical Analysis

Find answers to the following questions using the visual above, any links below, your big brain, and your knowledge of American government and politics:

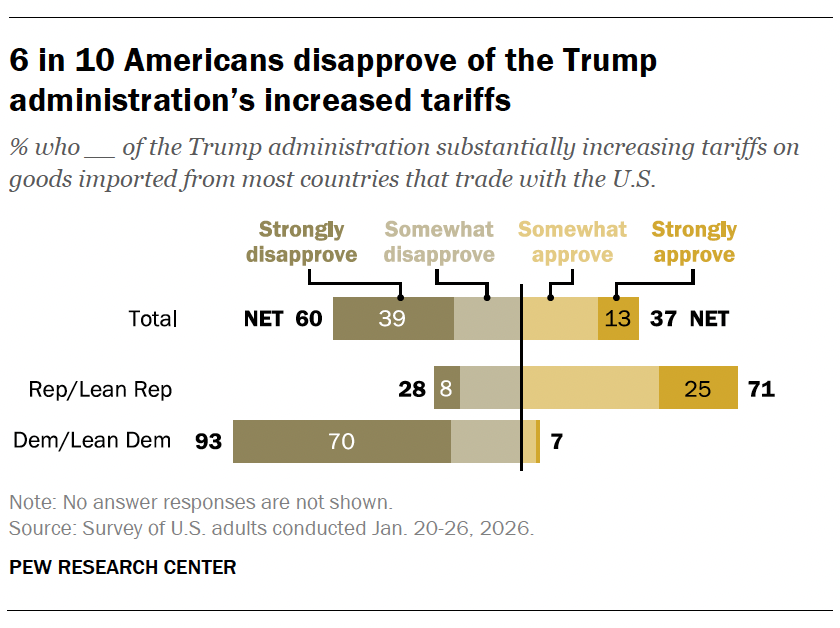

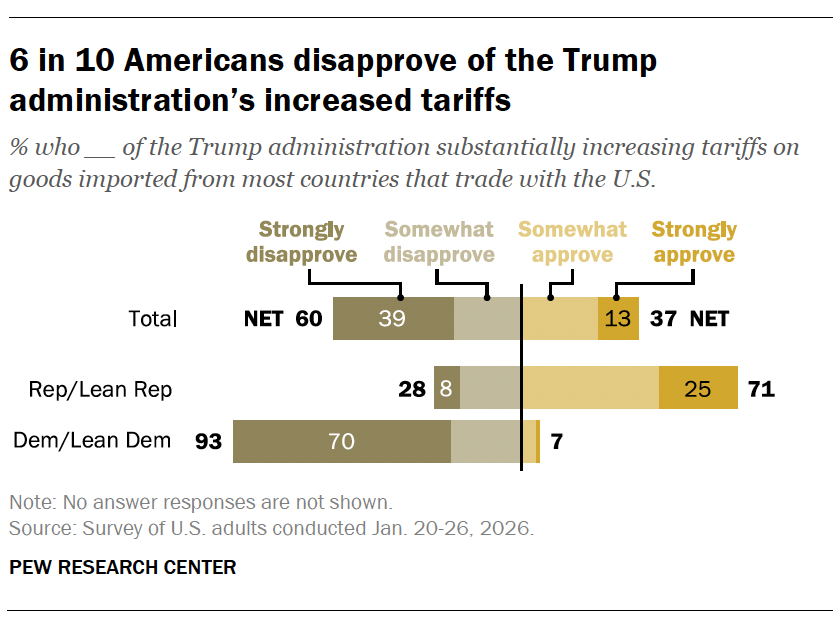

According to the visual above, what percent of all Americans either somewhat disapprove or strongly disapprove of Trump’s tariffs?

According to the visual above, what percent of Republicans and those who lean Republican either somewhat disapprove or strongly disapprove of Trump’s tariffs?

Last year Donald Trump slapped 25% tariffs on our closest trading partners Canada and Mexico. He also imposed 20% tariffs on our enemy China. Tariffs are taxes charged on goods imported from other countries. The companies that bring the foreign goods into the country pay the tax to the government. Typically, tariffs are a percentage of a product's value. Imposing a 20% tariff on Chinese goods means a product worth $10 would have an additional $2 charge applied to it which is usually passed on to the customer. In your own words: what are tariffs?

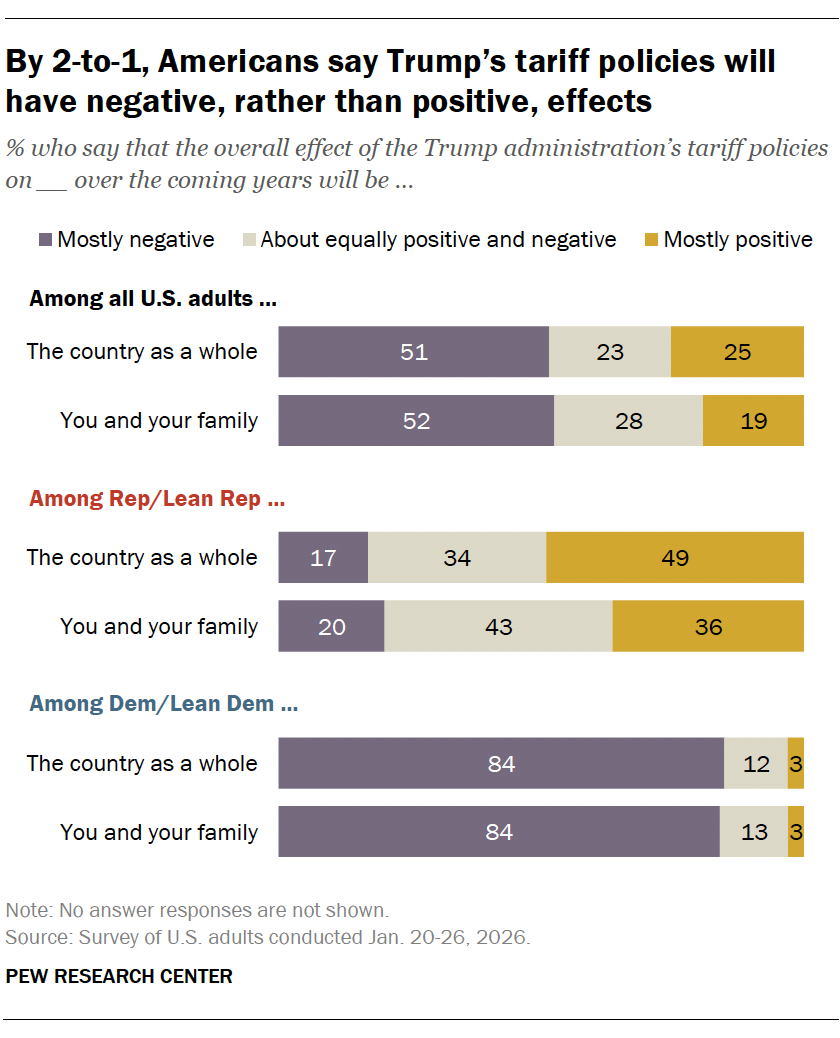

Economists across the political spectrum generally consider tariffs self-defeating since tariffs raise costs for companies who then pass the higher prices on to consumers. They're also likely to provoke retaliation from other countries that will slow American exports. How do you feel about tariffs?

To fight tyranny, Article I of the US Constitution gives congress alone the power to tax. A tariff is a tax, in this case, levied by the President. On Friday, February 20, the Supreme Court ruled 6-3 that President Trump's tariffs policies imposed under the International Emergency Economic Powers Act (IEPPA) are unconstitutional, dealing a major blow to the president's signature economic policy. What constitutional principle did this ruling demonstrate?

President Trump has said that his favorite word in the English language is tariffs. He likes tariffs because he can use their revenue however he likes: money for farmers, direct cash payments to taxpayers, a sovereign wealth fund to invest in companies, war fighting - disregarding the fundamental principle that spending, like taxing, is a power the Constitution assigns to Congress alone. In a news conference after the Supreme Court ruling, Mr. Trump said he would invoke a portion of law known as Section 122, which no president has ever used, to impose an across-the-board 10 percent tariff. Why do you think the Framers gave the power of the purse ($) to Congress instead of to the President?

Sen. Mitch McConnell (R-Ky.), former Senate majority leader and professional turtle impersonator, joined several other Republicans in commending the Supreme Court’s ruling against President Trump’s tariffs. McConnell wrote, “Today, the Supreme Court reaffirmed authority that has rested with Congress for centuries,” Despite Republican McConnell’s fight against Trump’s tariffs, why do you think so many members of Congress have abdicated their power?

There is no universal rule to determine what makes a poll ‘valid.’ However, the key things to look for are sample size (number of people surveyed) and corresponding margin of error (be cautious of results when the margin of error exceeds 5 or 6 points); whether the sample was scientifically chosen or whether respondents were self-selected; and the wording and order of the questions (look for questions that seem to ‘push’ the respondent to an answer by describing some options more attractively than others). Which of these rules do you think is most important?

Under Article I, Section 8 of the U.S. Constitution, Congress has the exclusive authority to "lay and collect Taxes, Duties, Imposts and Excises" and to regulate foreign commerce, making the power to tariff a core legislative function. Although the President’s tariffs have been ruled unconstitutional, the Congress very much has the power to make tariffs. Given the popularity of tariffs as shown in the visual above, do you think the Congress will now enact tariffs?

Trump’s tariffs imposed in 2025 and early 2026 have directly increased consumer and business prices in the U.S. across various sectors, including clothing, electronics, food, and vehicles. Studies indicate that U.S. companies and consumers bore the brunt of these costs, with tariffed goods seeing price increases of roughly 11% more than non-tariffed items. How have tariffs impacted you?

Write and Discuss

Take ten minutes to write about the question at the top of the page and then discuss with your classmates.

Act on your Learning

If you are a consumer (you are!) you can contact your Congressional representative and ask them about their position on tariffs.

Get Creative

Create a bumper sticker that is pro-tariff or one that is anti-tariff. Share your design with your classmates.

Learn More*

This lesson is here today but it will be gone tomorrow…unless you subscribe to our AP Government Archive.

Over 1000 amazing AP Government bell ringers tagged and searchable by topic; plus activities, games, reviews, and more. Cancel at any time. Use promo code SIGNMEUP at checkout to get the first month of our monthly subscription for free!