Bank Hate

Critical Analysis

Based on the visual above, in what year did Americans report the highest level of confidence in banks?

Based on the visual above, describe the trend in Americans’ confidence in banks.

A severe worldwide economic crisis in 2007-2008 was the most serious financial crisis since the Great Depression and resulted in huge losses to American financial institutions that were bailed out by the federal government with over $498 billion. What happened to American confidence in banking after the financial crisis.

Now that we are in the midst of another crisis and the government is again bailing out banks, what do you think will happen to Americans’ confidence in banks?

How would you describe your confidence in banks?

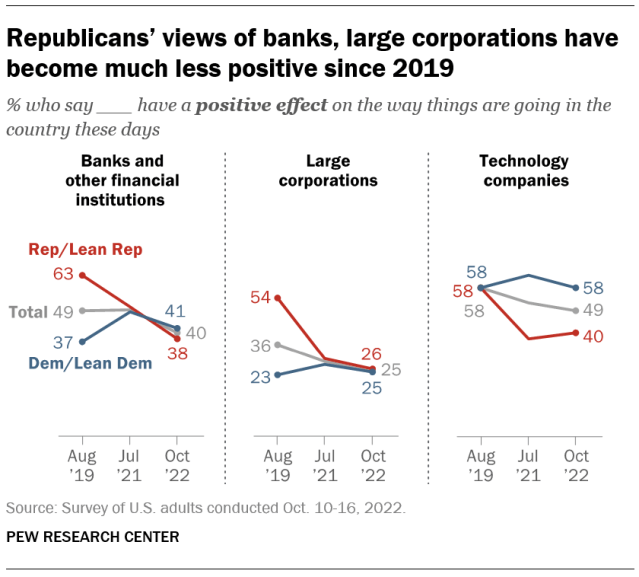

Based on the visual below*, how does political belief impact American’s views of banks?

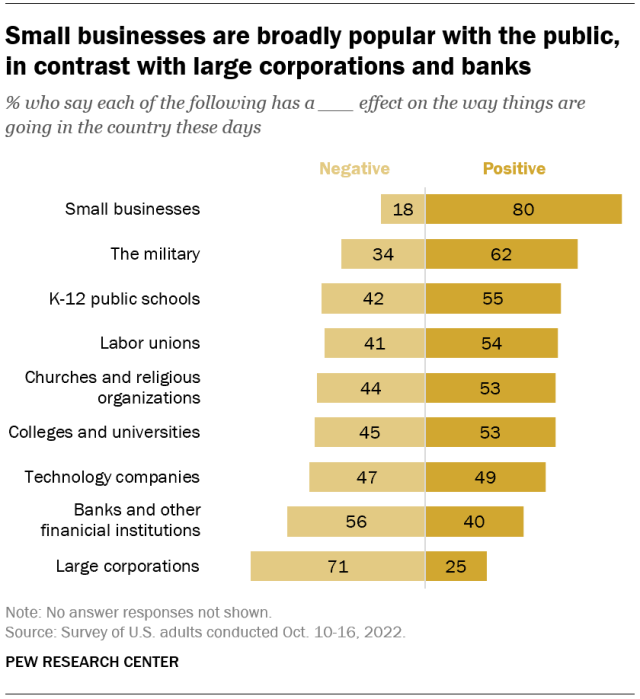

Based on the visual below*, regarding American confidence, how do banks compare to other institutions?

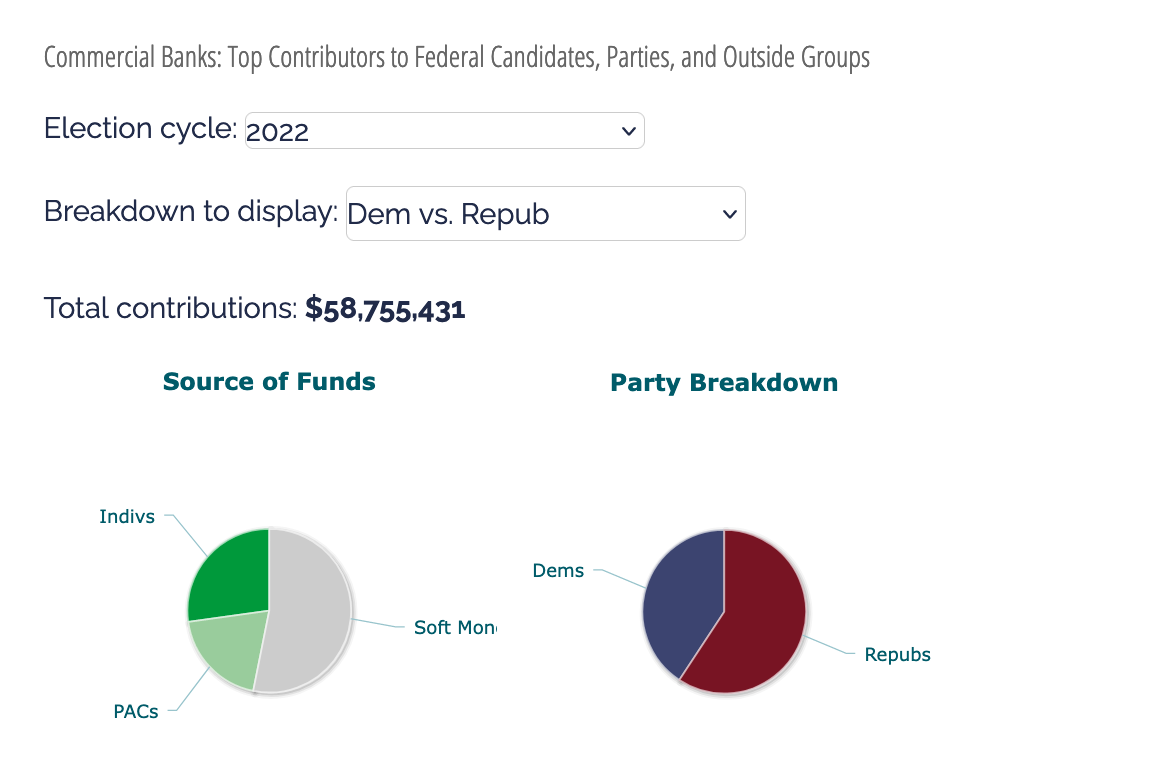

Sixty-six percent of Americans said there should be more regulation of “financial companies such as Wall Street banks, mortgage lenders, payday lenders, debt collectors and credit card companies.” Over half of Americans said the influence of big banks in Washington is too high. And a majority of Americans supported a number of policy proposals that have been introduced by Congress and regulators, including limiting the size and frequency of bank overdraft and credit card fees, lowering interest rates on high-cost loans and closing loopholes on fintech companies. Based on the visual below*, in the 2020 election cycle, how did banks use the political process to try to limit regulation?

A majority of Americans — 54 percent — said it’s very or somewhat likely that the recent collapse of SVB will start a broader financial crisis in the U.S., perhaps yet another indicator of how little confidence Americans have in banks post-2008. So far, federal intervention in the most recent crisis has been limited. Based on American’s views of banks, and also the amount of money banks have given to politicians, do you think the federal government will intervene to solve the current crisis?

Congress is divided on what actions to take after the recent bank failures. Some lawmakers have said regulators missed red flags. Others blame a Trump-era rollback of regulations for mid-size banks, and have signed on to Democrat-led bill to repeal those changes. It's likely congressional banking committees will hold hearings on the bank collapses; the Department of Justice has launched an investigation into what happened and the Federal Reserve is reviewing its oversight. How does this illustrate the concept of checks and balances?

Learning Extension

Listen to this short NPR story about how the government is responding to recent bank failures.

Action Extension

Contact President Joe Biden and tell him what he should do about the problems in the American financial sector.

Visual Extension

Get AP exam-ready with diagnostic tests, online review games, test review sheets, practice quizzes, full-length practice exam, and self-guided writing workshops. We'll make studying a breeze.