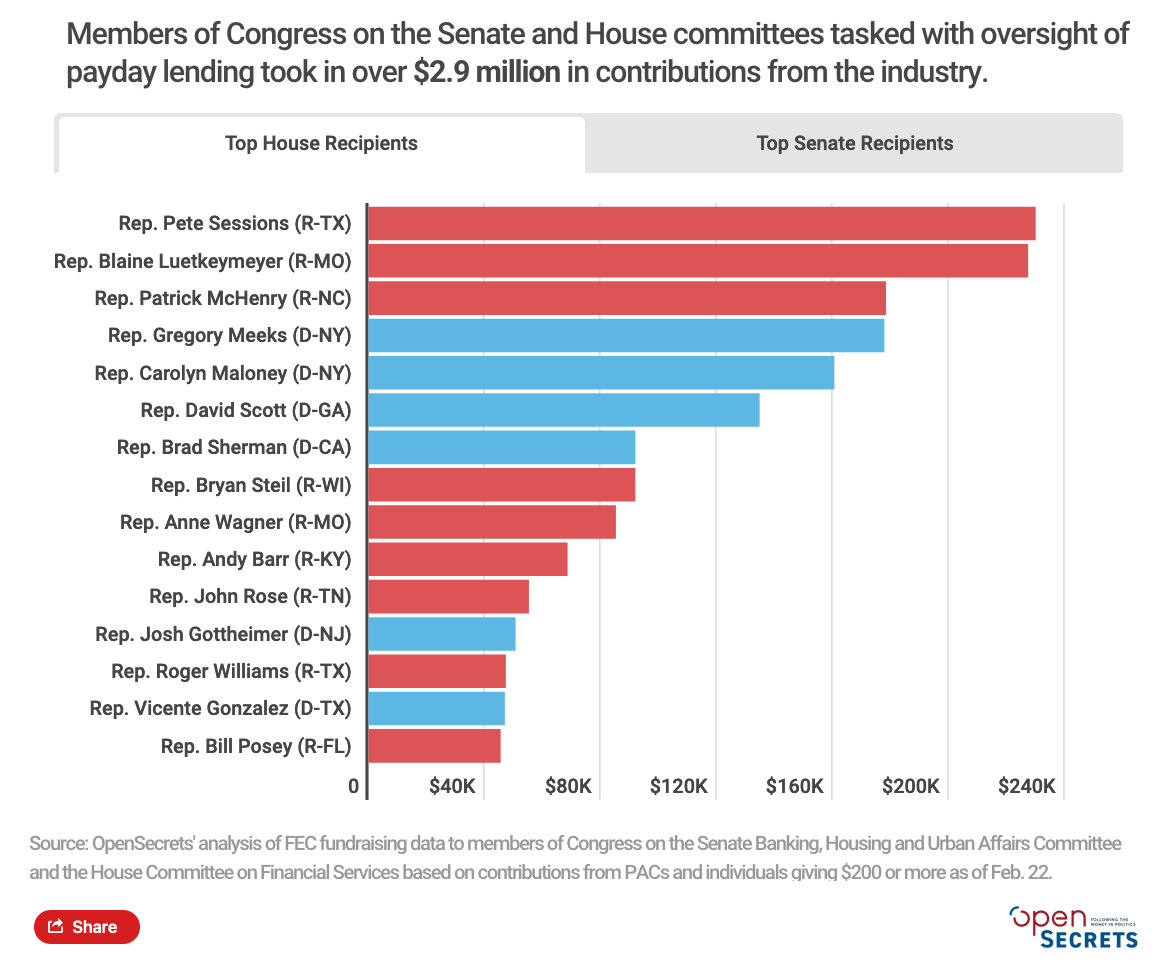

How much do the members of Congress in charge of regulating payday lending take in campaign contributions from payday lenders?

Critical Analysis

According to the data from the visual above, which U.S. House member took the most money from the payday lending lobbyists they were tasked with regulating?

According to the data from the visual above, how much money did Sen. Kyrsten Sinema (D-AZ) receive from the payday lending lobbyists she was tasked with regulating?

Describe one conclusion you can draw about American politics from the data in the visual above.

Members of Congress currently on the Senate Banking, Housing and Urban Affairs Committee and the House Committee on Financial Services collectively received over $3.4 million from the payday lending industry during their time in Congress, according to OpenSecrets data. Of the 78 senators and representatives on the committees, just 11 received no contributions from payday lending members or affiliates. In many jobs it would be considered a conflict of interest to receive money from the people you oversee. Is it legal for members of the House or the Senate to receive money from the very people they are charged with regulating and overseeing?

Explain the circumstances that might make someone borrow money at an interest rate of over 36% - an interest rate that would make it almost impossible to repay.

Imagine that the school board in your district was about to make new regulations for students. Then imagine that students started to pay money directly to members of the school board to influence the rules they wrote. Explain whether that would be ethical.

Both the House and Senate committees are tasked with regulating the payday lending industry, and are considering legislation to do just that. The Veterans and Consumers Fair Credit Act, which would cap the interest rate on extensions of consumer credit at 36%, was introduced in the Senate Banking Committee by Sen. Jack Reed (D-RI) in July 2021, and reintroduced in the House Committee on Financial Services in November 2021 by Reps. Jesus Garcia (D-IL) and Glenn Grothman (R-WI). Why does the payday lending industry want to have no cap on the rates they can charge borrowers?

As of Feb. 2021, 19 states and the District of Columbia have legislation capping interest rates at 36%. The federal government does not have a cap on lending. Explain how this illustrates the concept of federalism.

If you were a member of the U.S. Congress how would you vote on the Veterans and Consumers Fair Credit Act?

Describe the process of membership of committees such as the House Committee on Financial Services.

Learning Extension

Read this happy little story from Open Secrets about how the members who regulate payday lending are making money off of payday lenders!

Action Extension

Sen. Mike Crapo (R-ID) has received over $162,150 from Payday Lenders. Yes, his name really is Crapo. Contact Senator Crapo and let him know what you think about how he should vote in the Veterans and Consumers Fair Credit Act?