Tax The Poor

Who pays a higher tax rate in the U.S., the lowest or the highest paid Americans?

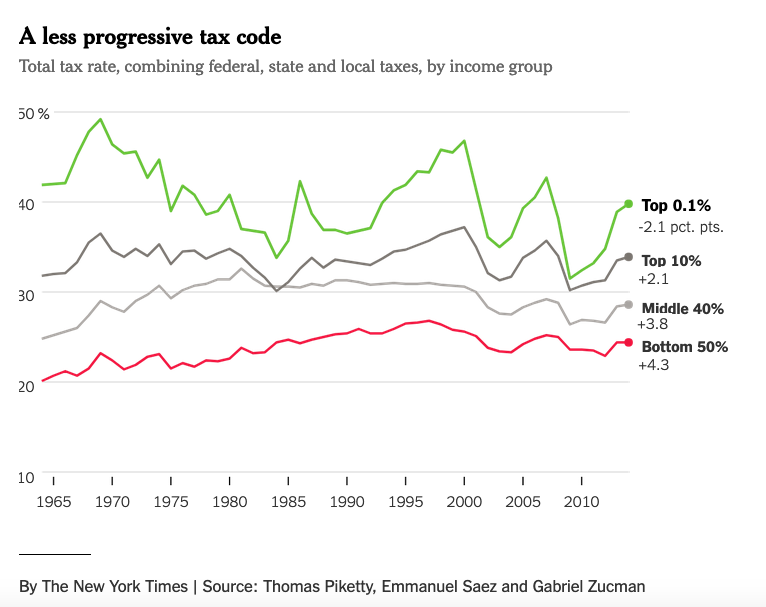

The overall tax rate on the richest 400 households last year was only 23 percent, meaning that their combined tax payments equaled less than one quarter of their total income.

How accurate was your prediction?

What story does this chart tell about tax rates in America today?

How does the tax rate for the rich and the poor compare today?

Why do you think that is?

What is one consequence of this?

How has the tax rate for the rich changed over the past half century?

Why do you think that is?

What is one consequence of this tax rate change for the rich?

If you were one of the 400 richest households in the U.S. would you want your tax rate lowered?

Warren buffet, America’s 3rd wealthiest person (net worth: $82 billion) famously pays less in taxes than his secretary. Make a claim about the fairness of this.

In what way are the following branches of government involved in making tax policy: Legislative, executive, judicial.

What would the following people say about the tax rate for the richest Americans: Socialist, liberal, conservative, Libertarian, the current POTUS.

By the middle of the 20th century, The United States had arguably the world’s most progressive tax code, with a top income-tax rate of 91 percent and a corporate tax rate above 50 percent. What would a government with higher tax rates have more of?

In the mid-20th century the U.S. government spent a large part of their tax revenue on things like the interstate highway program, fighting WWII, landing on the moon, Medicare and other programs. Was that a good investment in our nation?

The justification for lowering top income-tax rates was usually that the economy as a whole would benefit. This justification was known by various names such as supply-side economics or the trickle-down theory. The justification turned out to be wrong. The wealthy, and only the wealthy, have done fantastically well over the last several decades. G.D.P. growth has been disappointing, and middle-class income growth even worse. Explain whether you think the U.S. will reverse course and raise taxes on the richest Americans?

let’s say that your crazy uncle said that the data from the chart was fake. What would be three steps you could take to find out if this data were reliable?

if the overall tax rate on the richest 1 percent roughly doubled, to about 60 percent. The tax increases would bring in about $750 billion a year, or 4 percent of G.D.P. List the top three ways you would spend (or save) that revenue:

Imagine that you were a candidate for president and you ran on a platform of raising taxes on the wealthiest Americans. How do you think the average American would like that plan?

What could average Americans do to support such a plan?

How do you think the wealthiest Americans would like that plan to raise taxes on them?

What could wealthy Americans do to oppose a plan they did not like?

Do you think a candidate in 2020 with a plan to raise taxes on the wealthiest would most likely win election?